An Alternative to Government Scrappage Schemes

Following the introduction of the government’s scrappage scheme for 10 year old cars, it seems every industry being affected by the recession ( that means every industry) wants to generate some demand by introducing a scrappage scheme, justified by a reference to improved environmental performance.

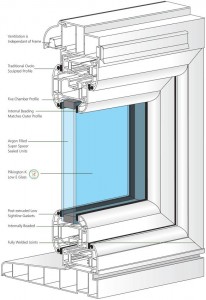

The only ones I’ve seen that I would be prepared to support are the boiler scrappage scheme, and the window scrappage scheme. That may be because I need a new boiler and replacement windows, but then I am typical of Adam Smith’s homo economicus. That is Adam Smith the economist, not Adam Smith my stepson.

I have a proposal, which I think wil be more effective than any scrappage scheme, would help the government reduce the National Debt, and would bring some peace to the AEC sector.

Over the last few months there has been a furore over Prince Charles’ alleged interference in the planning process over the Chelsea Barracks scheme.

Within the fenestration industry there has been outrage and accusation of a cartel over glass pricing.

More recently, the bonuses paid to Goldman Sachs employees has outraged all right thinking people.

However, I have a cunning plan…

How about the reintroduction of an ancient tax to address some of these issues?

In 1696 the Act of Making Good the Deficiency of the Clipped Money introduced a tax on glass.

Think about it…

A tax on glass would keep uPVC window fabricators happy – their frames are so wide they don’t use a lot of glass anyway.

The environmentalists will be happy because new houses built to Passivhaus standards wouldn’t need to compromise their total insulation approach by cutting holes in the walls for windows.

Demand for glass would reduce, thereby increasing competition and reducing the price.

Architects would be encouraged to revert to “classic” Norman or Gothic designs, so Prince Charles would be happy.

The government would be happy, because they’d receive a much-needed windfall from increased revenue from existing buildings.

Everyone else would be happy because banks would have to pay the most – and they’re the b@stards that got us into this mess in the first place.